Editor’s note: In Part 2, we focus on the challenges faced by drone tech startups, the Malaysia government’s initiatives to support the industry and some suggestions from drone tech companies. You can read Part 1 here.

The global market for Unmanned Aircraft Systems (UAS) or drones has grown significantly over the last decade.

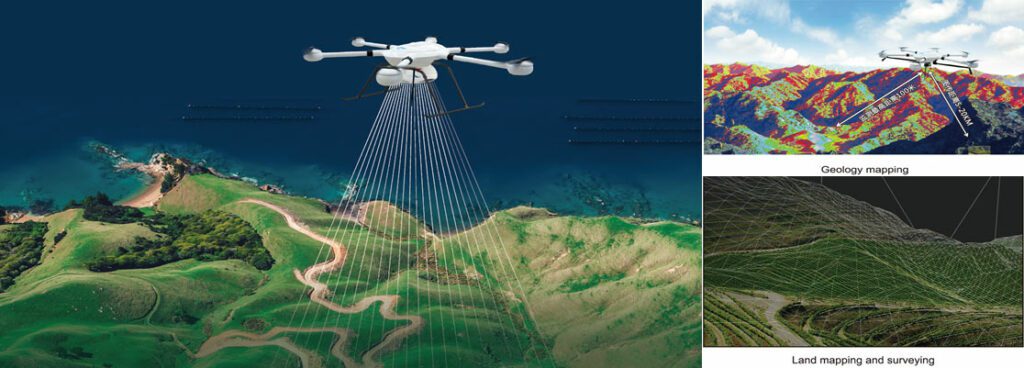

Rapid technological development on the hardware has resulted in robust and reliable aerial platforms now addressing a growing number of civil and industrial use cases, across a diverse set of verticals including oil & gas, agriculture, logistics, and many others, a white paper published by Huawei showed.

A number of challenges, however, still constrain widespread adoption of UAS technology in these commercial contexts.

“National aviation regulators must navigate supporting the industries that have emerged around nascent UAS technology, whilst at the same time assuring public safety and security as unmanned and manned vehicles share the skies,” the author Martin Creaner of Huawei SPO Lab said.

One of the key challenges drone tech firms face is to thread the fine line of encouraging innovation while maintaining public safety and confidence at the same time, according to Malaysia Digital Economy Corporation (MDEC) Chief Executive Officer Mahadhir Aziz.

“Also, drone tech companies may face regulatory hurdles as the drone regulation varies in different countries,” he told TechNode Global. In Malaysia, he said the Civil Aviation Authority of Malaysia (CAAM) has been actively engaging with drone tech companies to ensure public safety as well as facilitating technological advances.

While regulations are needed to be put in place to ensure safety of the public, Malaysian Research Accelerator for Technology and Innovation (MRANTI) CEO Dzuleira Abu Bakar said such regulations need to be adaptive to cater to the pace of technological advancement.

“Drone companies often need to abide by strict certification and compliance for drone operations, which may result in long periods for permits, limited guidelines for Beyond Visual Line of Sight (BVLOS) flights, and multi-agency approvals,” she said in a separate interview.

Challenges – funding, regulatory hurdles, talent & adoption

Besides regulations, both Aerodyne Founder and Chief Executive Officer Kamarul A Muhamed and VStream Revolution CEO Saravanan Chettiar agreed that the lack of talent and slow adoption are among the challenges faced by drone tech firms.

“Drone regulations are always stringent globally because drones are considered ‘high risks’, with concerns related to privacy and safety. [But] I’m supportive of having stringent and proper regulations in place,” Kamarul said. “For example in Australia, it is stringent in terms of regulation, but at the same time, it’s easy to operate businesses there. In Malaysia, I’m very encouraged by the support from the CAAM. Soon they’ll announce the authorized training organization. They are already putting in the structure that will make it easy for us to operate.”

He said drone tech firms have to look beyond the Malaysian market and build world-class technology to compete globally. While he noted universities in Malaysia are churning out good quality talents that drone tech firms can tap into, there is still insufficient talent for fast-growing tech firms like Aerodyne and the industry.

“This is especially so when we are trying to build world-class technology. We are not building technology only for Malaysia, but looking at technology that can be exported globally. This technology needs to be at par or better than technology that has been developed in Israel, Japan, in the US. Attracting the best talent is a challenge,” he said.

Kamarul, however, did notice that there are already a series of initiatives from various government agencies to support the drone tech industry.

“I think there’s a coordinated effort by the government to support the industry. This will result in better talent, and better support in terms of funding, visibility.”

Government’s initiatives

Malaysia government agencies such as MDEC, have designed and implemented several initiatives to fast-track growth of the country’s DroneTech industry and high potential companies such as DroneTech Testbed Initiative and collaboration with The World Economic Forum.

“We are proud to share that some of the Malaysia-based drone companies are part of MDEC’s Global Acceleration and Innovation Network (GAIN) program, which helps high potential Malaysian tech companies to scale up regionally and globally via four unique pillars – Gateway, Amplify, Invest and Nurture,” MDEC’s Mahadhir said.

In a recent report by Drone Industry Insights (DRONEII), a drone market research and analytics company, besides Aerodyne which came out first on the list, there are other also other Malaysia-based drone tech companies – Meraque (#19), Poladrone (#27), and OFO Tech (#36) included in the list.

Aerodyne, Poladrone, Meraque, OFO Tech, Avirtec have benefited in more ways than one, including greater visibility, market access and fundraising from MDEC’s GAIN program, he said.

For example, Poladrone received the Global Technology Fund from MDEC in 2020 to develop Oryctes, the world’s first precision spot spraying drone designed for oil palm.

“MDEC also works closely with other government ministries and partners such as MaGIC and partners via the National Technology & Innovation Sandbox (NTIS), Drone & Robotics Zone (DRZ) Iskandar, Area 57 of Technology Park Malaysia in building a vibrant ecosystem for drone technology,” he said.

MDEC also strongly encourages entrepreneurs and local SMEs to explore emerging opportunities and technology applications for industries such as agriculture, construction, energy, infrastructure, and public safety, he added.

MRANTI, a merged entity of MaGIC and Technology Park Malaysia under the Ministry of Science, Technology and Innovation, is also closely supporting the industry.

“Drones will be one of our immediate priorities in the first phase of MRANTI, through which we aim to build partnerships to bridge the gap between technology and industry demand, deploy intervention programs to support the drone tech ecosystem with the necessary programs and interventions to accelerate commercialization,” MRANTI CEO Dzuleira told TechNode Global. The government agency, which focuses on technology commercialization, also aims to provide facilities and infrastructure to nurture the growth of drone tech innovations.

“The task at hand is to create a basket of such companies and expand the ecosystem so that we elevate the rewards and returns from such ventures,” she added.

Government Funding

The National Budget for 2022 outlines several areas where drone tech and related industries will be given the spotlight as Malaysia strives to become the drone hub of Southeast Asia. This includes:

- $102 million to the Ministry of Science, Technology and Innovation (MOSTI) and the Ministry of Higher Education (MOHE) to intensify research and development (R&D) activities

- $24 million for exploration in the aerospace industry

- $7.2 million allocation for upgrading Technology Park Malaysia into an Industrial Revolution 4.0 (IR 4.0) Innovation Hub

- $4.8 million for Cradle Fund Sdn Bhd’s MyStartup Strategy program

- $1.2 million allocation to develop a Drone Sports Excellence Center under e-sports.

National Technology and Innovation Sandbox (NTIS)

In further gaining a fast-mover advantage, Dzuleira said the National Technology and Innovation Sandbox (NTIS), aims to foster the growth of the drone technology and robotics industry with four drone-related sandboxes launched within 12 months. This include:-

Agriculture Sandbox at FELDA Mempaga, Pahang, Robotics & Automation Sandbox at Drone and Robotic Zone Iskandar (DRZ Iskandar), Urban drone delivery in Cyberjaya and Area57.

Area 57

In September last year, Malaysia has launched a drone development zone Area 57, aiming to position Malaysia as a global drone tech ecosystem powerhouse. It aims to attract regional and global drone tech ecosystem players to participate and invest in Malaysia’s drone tech companies.

“Through Area 57, we can conduct more thorough case studies and encourage adaptive regulations that can spur innovations. It will allow more collaborations with other government agencies and authorities to ease the development of the drone tech industry,” Dzuleira said.

For example, last year, the CAAM launched three Civil Aviation Directives directly relating to drones allowing the industry as a whole to operate with more clarity and safety.

Among agencies that Area 57 will be cooperating with are Department of Survey and Mapping Malaysia (JUPEM), Malaysian Communications and Multimedia Commission (SKMM), SIRIM, Department of Environment and Chief Government Security Office.

“With Area 57 as a one-stop-center for the drone tech ecosystem, we hope to see more drone companies and academia from various higher educational institutions in contributing feedback to build a stronger ecosystem, she said.

Area 57 provides integrated facilities to UAS/drone innovators, developers and manufacturers in every step of the drone development lifecycle from the design phase, testing phase until the service and maintenance phase once the infrastructure is completed in the second quarter in 2023.

It will also assist the drone industry players and stakeholders in engaging with relevant government authorities and regulators for testing activities and certifications besides offering license certification training. It also engages with the communities and future generations through events and expos including seminars, exhibitions, roundtable sessions.

It is worth noting that besides providing a one-stop center to support the drone community from design to maintenance, Area 57 also aim to connect these companies with local authorities for testing and certification. More capacity-building programs will be offered soon, Dzuleira said. “Through MRANTI, we aim to build partnerships to bridge the gap between technology and industry demand, deploy interventions programs to support the drone tech ecosystem, and to provide facilities and infrastructure to nurture the growth of drone tech innovations.”

According to her, the prioritized sectors for Drone Tech in Malaysia include:

- agriculture

- logistics

- Filmmaking / Photography / Recreation

- Defence / Law Enforcement

- Disease Control

- Conservation

- Disaster Mitigation & Relief

- Internet Service Provider

- Real Estate / Construction Planning

- Energy

In January, Iskandar Investment Bhd (IIB), which counts Malaysia sovereign fund Khazanah Nasional and Employees Provident Fund as shareholders, opened a drone test site (DTS) in Malaysia, the largest in Southeast Asia. The Iskandar drone and robotic zone (DRZ Iskandar) aims to create a drone and robotics ecosystem. It is projected that DRZ Iskandar will bring in MYR351 million investments and generate 1,000 high-value jobs by 2025 in drone and robotics.

Suggestions

Taking a cue from China where there is the emergence of tech giants such as Alibaba, Baidu, Tencent and Xiaomi, Aerodyne’s Kamarul said the government should also support and encourage the adoption of technology.

Drone tech companies, on the other hand, should better position themselves and focus on specific markets, collaborate and find ways to complement each other, he said.

“Malaysian players should get together. We can still have healthy competition but let’s come together to build the ecosystem,” he said. “Drone startups should find their own niche, develop solutions which can provide value to their clients.”

For example, instead of trying to build a drone, or hardware, which some of the larger corporations like China-based DJI have invested significantly and command a substantial market share, they can focus on building next-generation sensors or battery systems.

While it may not be easy for drone tech firms to export their services due to strict regulations, Malaysian firms can work with and invest in local partners in foreign markets, Kamarul added, as he shared Aerodyne’s experience.

He also suggested government-linked companies (GLCs) to work and collaborate with tech firms, and adopt local technology to help create a stronger tech ecosystem.

More testing sites, funding, and collaboration with large corporations are some of the ways to support the drone tech industry, VStream Revolution CEO Saravanan Chettiar told TechNode Global.

“We should have more drone R&D sites or test sites that can be used by drone tech companies with facilitation for permit application,” he said.

There should be more investments or fundings made available for startups and strategic partnerships with industry players including national oil firm Petronas, state-owned palm oil plantation agency Felda, Malaysian Highway Authority (LLM) and others, he suggested.

MDEC’s Mahadhir suggested drone tech startups to understand the drone landscape in Malaysia and also globally.

“Pay close attention to not only the market needs but also to the local regulations. Secondly, MDEC strongly recommends drone tech startups to engage us. MDEC is here to help startups navigate through the industry as we have established a strong network and support in the drone tech industry. Our support can range from networking, business facilitation, to market access among others,” he said.

MDEC will continue to work closely with the relevant Ministries, agencies and ecosystem players and will be guided by the MyDigital blueprint and the National Fourth Industrial Revolution (4IR) Policy, he added.

Malaysia’s drone tech hub ambition: Opportunities & Challenges [Part 1]

0 Comments